#GoodReads – May Stats

“May Inventories Rise to Levels Not Seen Since Before the Pandemic”

“SALES SLOW AS NEW LISTINGS RISE”

Via: RAHB. |

|

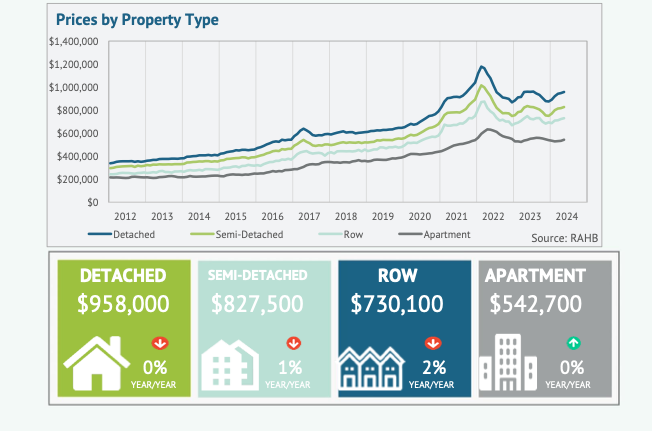

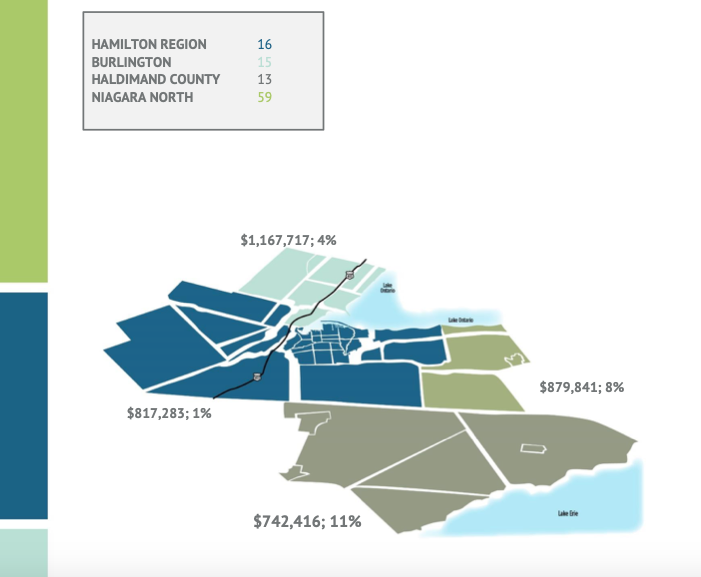

| “…The REALTORS® Association of Hamilton-Burlington (RAHB) noted 1,032 sales in May, marking a 20 per cent decrease compared to the previous year and 31 per cent below the long-term average for the month. This decline in sales was evident across all property types and was significant enough to counterbalance the gains seen earlier in the year, resulting in a three per cent decrease in year-to-date sales.

A decline in sales was accompanied by an increase in new listings, resulting in a decrease in the sales-to-new-listings ratio to 46 per cent in May. Although new listings showed improvement across various price brackets, the most significant surge was observed in homes priced above $1,000,000. Consequently, the collective effect of reduced sales and heightened new listings led to a notable 56 per cent increase in inventory levels compared to May of the previous year, marking the highest May level reported since 2018.

‘Inventory levels are on the rise across all price ranges, with the most significant increases observed in the higher-priced products. This surge can be attributed to the current high- interest rate environment, which is motivating more sellers to list their properties in this bracket. However, the flip side of this trend is that escalating costs and higher interest rates are affecting consumer affordability, causing some potential buyers to pause their purchasing decisions,’ says Nicolas von Bredow, President of the REALTORS® Association of Hamilton- Burlington (RAHB).

The fluctuations in both sales and inventory levels have fostered the most balanced conditions in over a decade, effectively mitigating any notable shifts in home prices on a year-to-date basis. In May, the total unadjusted residential benchmark price stood at $868,300, reflecting a one per cent increase compared to the previous month, yet nearly one per cent lower than the levels recorded in May of the previous year.” |

|

To read the full article, click here.